Market Expansion Services Company in Delhi, India

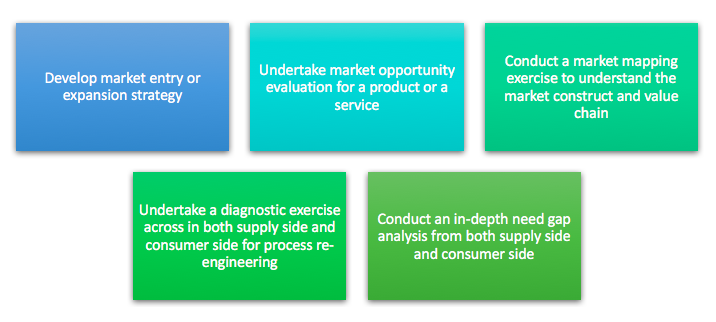

Market Link ** a proprietary process used for opportunity assessment to facilitate market entry/expansion of the category into India Market / specified region. It is a consultative module that seeks to facilitate Market mapping/sizing/market expansion strategy development.

It is a consultative module that seeks to facilitate Market mapping/sizing/market expansion strategy development. The process delivers “market opportunity evaluation” as well as “enumerates key success factors” for the market as the key output for the study

The module seeks to understand & map the entire value chain – rather than adopting a piece-meal approach.

The module uses a mix of both secondary and primary research –

- Secondary Research – includes intensive desk search, sourcing published data by nodal agencies/industry associations/journals, news articles, referring to sector reports, etc.

- Primary Research – market visits by the core research team in all key markets using the in-depth Delphi interview method (we use the snow-balling technique to identify and interview the “right/relevant” set of people in the entire value chain)

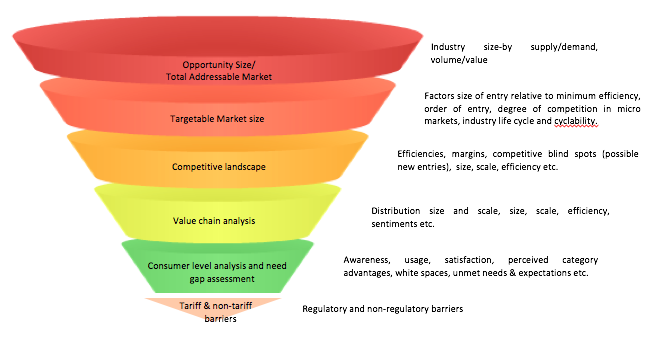

Key Information Areas

- Domestic market size by volumes

- Imported market sizes for last 5 years

- YOY growth rate for last 5 years

- Sizes by volumes for key countries of import

- Consumption avenues for domestic & imported category

- By geographies – Tier I, II and III cities

- By consumer segments – Unorganized, organized / modern retail and Institution

- Value chain construct for domestic & imported variants

- Seasonality – months of availability in the market

- Pricing – wholesale and retail

- Performance of imported variants in last 5 years in various geographies & consumption segments

- Reasons for preference

- Awareness of variants – Top of mind, Spontaneous awareness and aided awareness

- Frequency of consumption, Occasions of consumption

- Who influenced the decision of preferring imported over domestic

- Place of purchase – traditional outlets or modern retail outlets

- Preferred retail chains for purchasing

- If the purchase visit is planned or impulse

- Frequency of purchase, Aspects looked at while purchasing

- Triggers / barriers to adoption – Is it related to health attributes?

- Perspective towards – taste attributes, shelf life etc.

- Price premium and sensitivity – reactions to current pricing levels